Page 16 - 2021 Summer Enrollment

P. 16

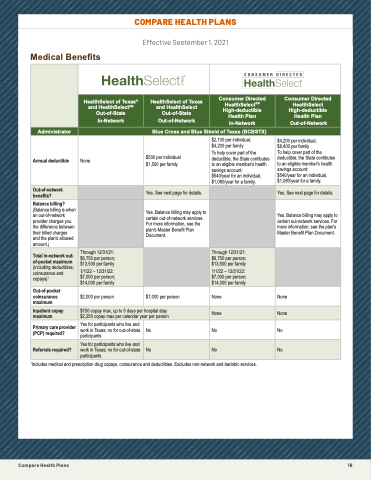

EFFECTIVE SEPTEMBER 1, 2021

This chart shows your share of costs for commonly used medical, mental health, prescription drug and diabetes supply benefits in

® SM

the HealthSelect of Texas and Consumer DiCreOcteMd PHeAalRthSEeleHctEAplLanTs.HFoPr iLn-dAepNthSinformation about eligibility, services that are

covered and not covered, and how benefits are paid, view the Master Benefits Plan Document (MBPD) on your plan’s website. If there is a conflict between the MBPD, MBPD Amendments and this chart, the MBPD and its Amendments will control.

Effective September 1, 2021

Blue Cross and Blue Shield of Texas (BCBSTX) administers medical and mental health benefits in both plans. OptumRx, an affiliate of UnitedHealthcare, manages prescription drug benefits for the plans. As administrators, they process claims and oversee the provider MnetweodrkiscanadldrBugefonrmeulfiarites. ERS designs the benefits and pays the claims.

Service

Allergy treatment Ambulance services

HealthSelect of Texas® and HealthSelectSM Out-of-State

In-Network

HealthSelect of Texas and HealthSelect Out-of-State

Out-of-Network

Consumer Directed HealthSelectSM High-deductible Health Plan

In-Network

Consumer Directed HealthSelect High-deductible Health Plan

Out-of-Network

® CoHveraeldthaSt 1e0l0e%ctifoafdmTeinxisatesred

in a pahnydsicHiaena’slothffiSce;l2e0c%tSM

coinsuranOcue tin-oafn-ySottahter

outpatient location

In-Network

HealthSelect of Texas 40% caonindsuHraenaceltahfSteer alencnutal d e d u c t i b l Oe i u s t m - o e f t - S t a t e

Out-of-Network

20% coinsurance; annual

Consumer Directed

HealthSelectSM

20% coinsurance after annual

High-deductible

deductible is met

Health Plan

In-Network

20% coinsurance after annual

Consumer Directed

HealthSelect

40% coinsurance after annual

High-deductible

deductible is met

Health Plan

Out-of-Network

20% coinsurance after annual

Administrator

(for emergencies)

20% coinsurance

Blue Cross and Blue Shield of Texas (BCBSTX)

deductible does not apply deductible is met in-network deductible is met

Bariatric surgery2 Annual deductible

Chiropractic care

• Deductible: $5,000

• Coinsurance: 20%

• Lifetime max: $13,000

None

• Without office visit: 20%

coinsurance

• With office visit: $40 copay plus 20% coninsurance

Not covered

$500 per individual

$1,500 per family

40% coinsurance after annual deductible is met.

Maximum benefits of $75 per

$2,100 per individual,

To help cover part of the deductible, the State contibutes to an eligible member's health 2s0a%vincgosinascucroaunncte: after annual d$e5d4u0c/ytiebaler ifsormaent.individual,

$1,080/year for a family. Maximum benefits of $75 per

$4,200 per family Not covered

$4,200 per individual,

$8,400 per family Not covered

To help cover part of the

deductible, the State contibutes

to an eligible member's health

savings account:

40% coinsurance after annual

d$e5d4u0c/ytiebaler ifsormaent.individual,

$1,080/year for a family. Maximum benefits of $75 per

Out-of-network benefits?

• Maximum benefits of $75 per visit and maximum of 30 visits

visit and maximum of 30 visits

Yes. See next page for details. per calendar year

visit and maximum of 30 visits per calendar year

visit and maximum of 30 visits

Yes. See next page for details. per calendar year

Balance billing?

(Balance billing is when

Diabetes

an out-of-network

equipment2 provider charges you

the difference between Dthieairbbeitllesd scuhaprpgleiess and the plan's allowed Damiaogunnot.s)tic X-rays

per calendar year

20% coinsurance;

see page 20 for details.

20% coinsurance

40% coinsurance after annual Yes. Balance billing may apply to deductible is met;

certain out-of-network services. see page 20 for details.

For more information, see the

plan's Master Benefit Plan

See page 2 40% coinsurance after annual

Document.

20% coinsurance after annual deductible is met;

see page 20 for details.

0 for details.

20% coinsurance after annual

40% coinsurance after annual dYedsu. cBtaiblalenicsembeillti;ng may apply to sceertapiangoeu2t-0nefotwr doerktasilesr.vices. For more information, see the plan's Master Benefit Plan Document.

40% coinsurance after annual

and lab tests

Total in-network out- Diagnostic

of-pocket maximum mammography

(including deductibles,

Durable medical

coinsurance and

equipm1ent2 copays)

Facility-based

Through 12/31/21:

$6,750 per person; Covered at 100% $13,500 per family

1/1/22 – 12/31/22: 20% coinsurance $7,000 per person;

$14,000 per family

deductible is met

40% coinsurance after annual deductible is met

40% coinsurance after annual deductible is met

deductible is met Through 12/31/21:

2$06%,75c0oipnesrupraenrscoena;fter annual d$e1d3u,5c0ti0blpeeisr fmametily

210/1%/2c2o–in1s2u/r3a1n/c2e2:after annual d$e7d,0u0c0tibplerispemrseot n;

$14,000 per family

deductible is met

40% coinsurance after annual deductible is met

40% coinsurance after annual deductible is met

Emergencies: 20% coinsurance;

annual deductible does not $7,000 per person

apply.

Non emergencies: 40%

care (non FSER)

1Idneclpuadretms emnetsdical and prescription drug copays, coinsurance anpdlusde4d0u%ctciboliens.uEraxnccluedaeftsernaonn-nueatlwork and bariatric services.

Emergencies: 20% coinsurance

after annual in-network None

deductible is met.

Non emergencies: 40%

No

Emergencies: 20% coinsurance

after annual in network

network deductible is met.

Emergencies: 20% coinsurance after annual in-network deductible is met.

Non-emergencies: 40% coinsurance after annual out-of- network deductible is met.

40% coinsurance after annual deductible is met

pOruotv-oidf-eproscket (croaidniosluorgaisntcse, pmaathxoimlougmists and labs,

physicians etc.)

$2,000 per person 20% coinsurance

Yes for participants who live and

work in Texas; no for out-of-state

$150 copay plus 20% coinsurance

20% coinsurance

None

20% coinsurance after annual

deductible is met No

anesthesiologists,

Inpatient copay

emergency room

maximum

$750 copay max, up to 5 days per hospital stay

coinsurance after annual

$2,250 copay max per calendar year per person deductible is met

-

None

-

coinsurance after annual out-of- None

network deductible is met.

Primary care provider

Emergencies: $150 copay plus No

(PCP) required? Facility emergency

participants

$150 copay plus 20%

20% coinsurance (If admitted, copay will apply to hospital

-

and hospital-affiliated

Referrals required?

freestanding emergency

Yes for participants who live and coinsurance

work in Texas; no for out-of-state (If admitted, copay will apply to participants

hospital copay.)

copay.) Annual deductible does

No

not apply.

Non-emergencies: $150 copay

20% coinsurance after annual

No

deductible is met

deductible is met.

No

Non-emergencies: 40%

-

coinsurance after annual out-of-

Freestanding emergency room facility

Habilitation and rehabilitation services - outpatient therapy (including

out-of-network deductible is met.

Emergencies: $300 copay plus 20% coinsurance; annual deductible does not apply.

Non-emergencies: $300 copay plus 40% coinsurance after annual out-of-network deductible is met.

40% coinsurance after annual deductible is met

20% coinsurance after annual deductible is met

20% coinsurance after annual deductible is met

2

physical therapy, occupational therapy and speech therapy)

Compare Health Plans

16

.

Preauthorization may be required